14/02/2026

General

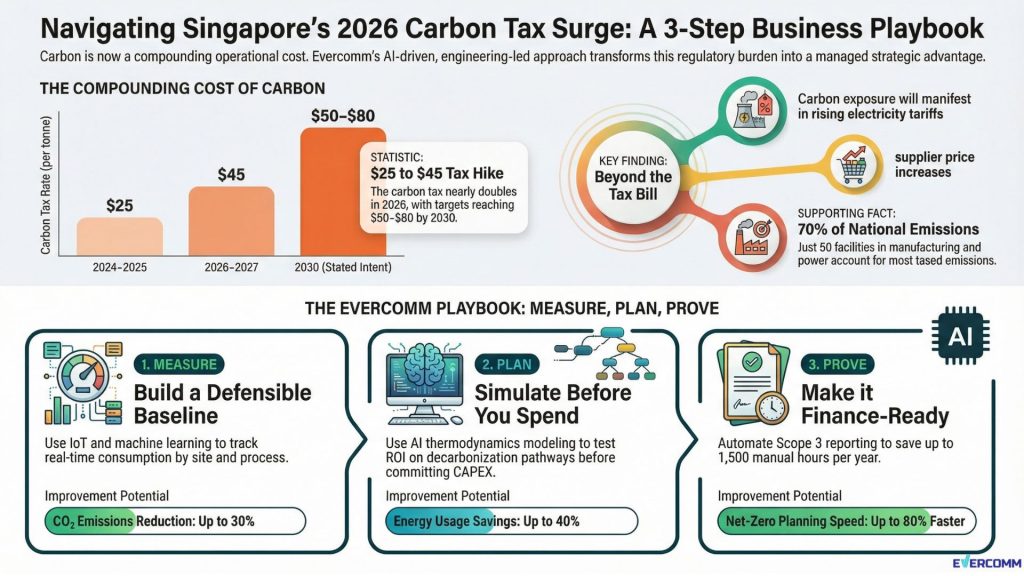

Singapore’s carbon tax has almost doubled to $45 per tonne in 2026, and the signal to business is clear: carbon is now a cost that will keep compounding.

The Straits Times focused on the household impact (about $3/month for a typical four-room flat, excluding GST, assuming other tariff drivers stay constant). But for businesses, the bigger story is not the household number—it’s what it implies for operating costs, supply chain pricing, and competitiveness as carbon prices rise.

A few datapoints from the article that matter for corporate planning:

For business leaders, this adds up to one message: carbon exposure won’t just show up in your carbon tax bill (if you pay it). It will show up in your electricity costs, your suppliers’ pricing, and—soon enough—your access to capital.

Carbon pricing is doing what it’s designed to do: put a real price on pollution.

The businesses that get caught out aren’t necessarily the biggest emitters—they’re the ones that can’t answer, quickly and credibly:

This is exactly why Evercomm’s operational approach starts with three questions: how much you consume, how much you need, and how much you waste—so decisions move from guesswork to evidence.

1) Measure: build a baseline you can defend

If you can’t measure reliably, you can’t manage exposure.

Evercomm’s Energy Management System (EMS) uses IoT and machine learning to simplify energy management, with real-time tracking of energy/operational efficiency and dashboards that link usage to cost.

2) Plan: test pathways before you spend CAPEX

As carbon prices rise toward 2030, “we’ll do efficiency” isn’t a roadmap.

Evercomm’s PATHMATCH platform is powered by an AI simulation engine built on thermodynamics modelling, designed to generate scientifically calibrated forecasts and tailored decarbonisation roadmaps. It was developed over years with an R&D investment of SGD $18.7 million.

3) Prove: make it finance-ready (because finance is moving fast)

The article highlights allowances, offsets, and planned disclosure—signals that carbon policy is maturing.

In parallel, banks are under pressure to manage Scope 3 financed emissions and comply with standards such as PCAF and IFRS S2.

PATHMATCH is designed to help financial institutions assess decarbonisation impact and automate parts of financed-emissions work—saving up to 1,500 hours/year in manual effort (as referenced in Evercomm materials).

Evercomm’s brand narrative is clear: help organisations know their carbon emission state with actionable data, within global ISO frameworks, so efforts are recognised—and translate into “real change” and “real benefits.”

With carbon tax moving from $25 to $45—and with a stated trajectory toward $50–$80—leaders can’t afford to wait for the cost to “show up” before acting.

Carbon tax is rising again. The organisations that win won’t be the ones that “absorb” the increase. They’ll be the ones that measure precisely, plan intelligently, and prove credibly—so carbon becomes a managed variable, not a recurring shock.

If you want to quantify exposure and prioritise the highest-impact moves first, Talk to Evercomm about building a trusted baseline and a finance-ready decarbonisation roadmap.

Evercomm is a multi-award winning engineering and technology company helping industries build resilience, unlock growth opportunities and navigate the evolving regulations landscape across carbon, energy, waste, and beyond.

Since 2013, we have been helping businesses optimise resource efficiency, reduce carbon emissions, manage climate risk scenarios, and meet international compliance standards ensuring long-term operational and financial sustainability.

Our advanced planning and simulation tools provide precision-driven carbon, energy and waste reduction strategies tailored to your unique operations. Grounded in internationally recognised ISO Standards, Evercomm ensures data integrity, credibility, and verifiability in emissions reduction tracking and reporting. By integrating globally recognised compliance frameworks, including GRI, SBTi, ISSB, and ESRS, we enable organisations to meet stringent regulatory requirements while reinforcing their business resilience.

As a trusted partner, Evercomm helps businesses turn compliance obligations into strategic advantages ensuring they stay ahead in a rapidly shifting economic and regulatory environment.